Cryptocurrency shiba inu

A hard fork is a radical change to the protocol that makes previously invalid blocks/transactions valid, and therefore requires all users to upgrade. For example, if users A and B are disagreeing on whether an incoming transaction is valid, a hard fork could make the transaction valid to users A and B, but not to user C https://petreewebdesign.com/popular-website-styles-in-web-design/.

Another point that Bitcoin proponents make is that the energy usage required by Bitcoin is all-inclusive such that it encompasess the process of creating, securing, using and transporting Bitcoin. Whereas with other financial sectors, this is not the case. For example, when calculating the carbon footprint of a payment processing system like Visa, they fail to calculate the energy required to print money or power ATMs, or smartphones, bank branches, security vehicles, among other components in the payment processing and banking supply chain.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Cryptocurrency prices

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

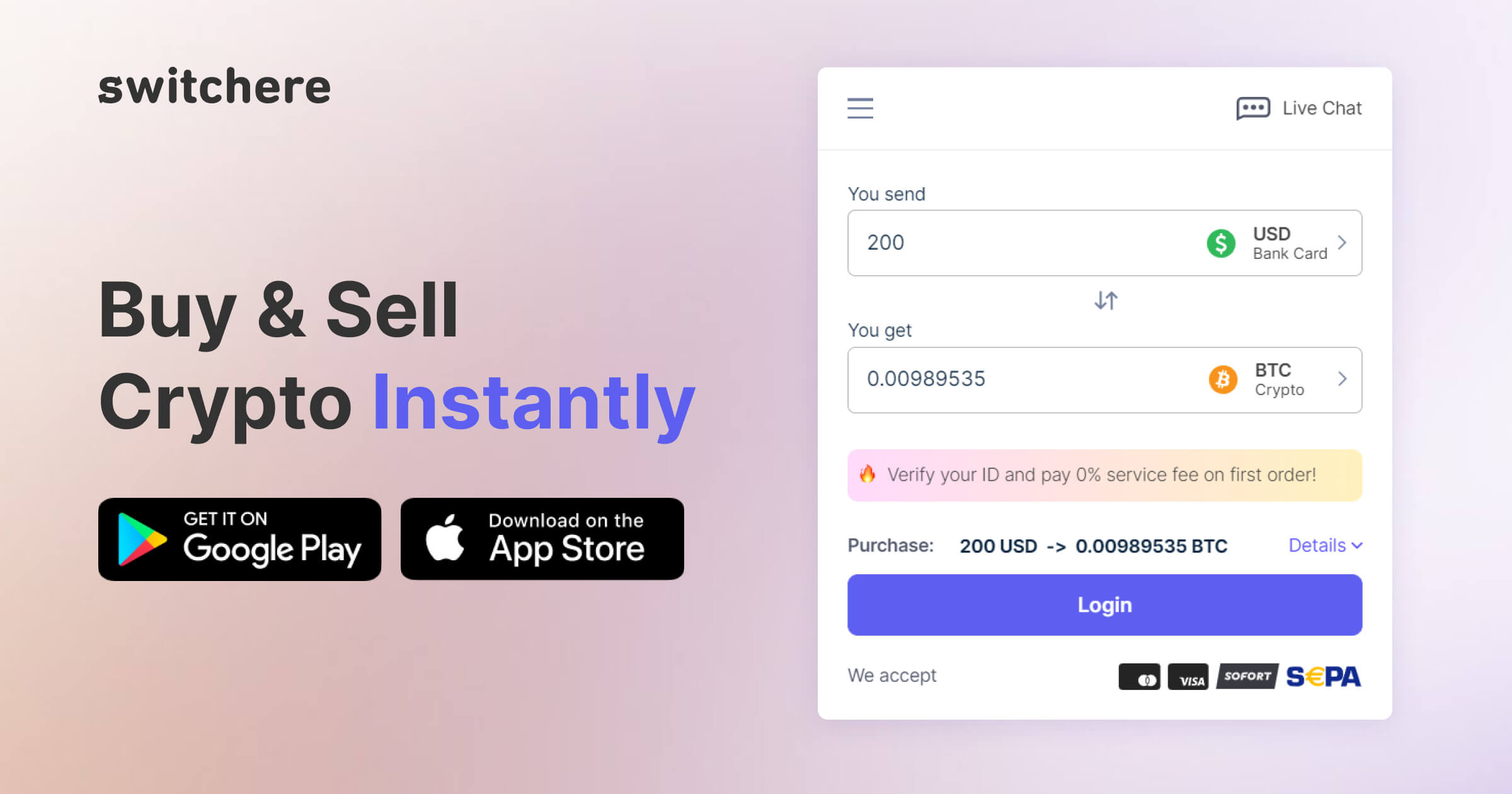

Cryptocurrency exchanges provide markets where cryptocurrencies are bought and sold 24/7. Depending on the exchange, cryptocurrencies can be traded against other cryptocurrencies (for example BTC/ETH) or against fiat currencies like USD or EUR (for example BTC/USD). On exchanges, traders submit orders that specify either the highest price at which they’re willing to buy the cryptocurrency, or the lowest price at which they’re willing to sell. These market dynamics ultimately determine the current price of any given cryptocurrency.

The circulating supply of a cryptocurrency is the amount of units that is currently available for use. Let’s use Bitcoin as an example. There is a rule in the Bitcoin code which says that only 21 million Bitcoins can ever be created. The circulating supply of Bitcoin started off at 0 but immediately started growing as new blocks were mined and new BTC coins were being created to reward the miners. Currently, there are around 19.86 million Bitcoins in existence, and this number will keep growing until the 21 millionth BTC is mined. Since 19.86 million BTC have been mined so far, we say that this is the circulating supply of Bitcoin.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

However, Bitcoin is far from the only player in the game, and there are numerous altcoins that have reached multi-billion dollar valuations. The second largest cryptocurrency is Ethereum, which supports smart contracts and allows users to make highly complex decentralized applications. In fact, Ethereum has grown so large that the word “altcoin” is rarely used to describe it now.

Cryptocurrency shiba inu

The market momentum affecting Shiba Inu can mainly be attributed to Tesla CEO Elon Musk, who was also responsible for dogecoin’s massive price surge. Musk’s interest in dogecoin creates the market’s excitement for SHIB. Musk even got a Shiba Inu puppy, named Floki Frunkpuppy, triggering another market surge.

In January 2023, the Shiba Inu community leadership introduced Shibarium, a layer two blockchain designed to run on top of Ethereum. This update was released to reduce congestion, introduce staking into the ecosystem, lower gas fees, and provide a framework for decentralized applications and Web 3 expansion.

Since SHIB doesn’t yet have a solid use case, unlike many other major cryptocurrencies, it’s difficult to set a fundamental valuation or a floor price for it. The community being sundered could be catastrophic for its price.

Similar to Dogecoin, Shiba Inu’s major differentiating factor is its community. A single day after its July 2021 launch, ShibaSwap saw $1 billion in liquidity, showing the level of investment of its community.

Hawk tuah girl cryptocurrency lawsuit

In the lawsuit filed Thursday against the $HAWK creators in New York District Court, investors accused overHere Ltd, its founder Clinton So, social media influencer Alez Larson Schultz and the Tuah The Moon Foundation of fraudulently selling Welch’s celebrity memecoin, per Hollywood Reporter.

The plaintiff attorneys say in their filing: “Through aggressive promotional campaigns and promises of future growth, Defendants created a speculative frenzy that caused the Token’s market value to spike shortly after launch, reaching a significant market capitalization. Defendants leveraged Welch’s celebrity status and connections to enhance the Token’s credibility and appeal, including discussing the $HAWK project during Welch’s podcasts featuring notable guests.”

Despite the coin bearing her “Hawk Tuah” brand, there has been radio silence on the controversy from Welch. She has not posted on her social media or uploaded a new podcast episode since the coin crashed.

A memecoin is a type of cryptocurrency that is typically launched on the back of a popular internet meme or recurring joke. Welch is not named as a defendant in the case, which was launched in federal court in the eastern district of New York.

The sudden drop in value caused backlash from Welch’s fans, with one person calling her out online as they wrote: “I am a huge fan of Hawk Tuah but you took my life savings. I purchased your coin $Hawk that you were so excited about with my life savings and children’s college education fund as well.”